The Federal Reserve's FOMC meeting plays a crucial role in shaping the U.S. economy and global financial markets. As one of the most important economic events, it influences interest rates, monetary policy, and overall economic stability. Understanding the mechanics and significance of these meetings is essential for investors, economists, and anyone interested in the financial world.

Every six weeks, the Federal Open Market Committee (FOMC) gathers to assess the state of the U.S. economy and determine the appropriate monetary policy. These meetings are pivotal because they directly impact interest rates, which in turn affect borrowing costs, consumer spending, and investment decisions. The outcomes of these meetings can have far-reaching consequences for both domestic and international markets.

As a cornerstone of economic decision-making, the FOMC meeting is closely watched by economists, investors, and policymakers. The decisions made during these sessions can influence stock prices, currency values, and inflation rates. In this article, we will delve into the intricacies of the FOMC meeting, explore its significance, and examine how it impacts the global economy.

Read also:Randy Travis Health The Journey Of Resilience And Recovery

Table of Contents

- What is FOMC?

- FOMC Meeting Overview

- Key Decisions Made During FOMC Meetings

- Economic Impact of FOMC Meetings

- How FOMC Meetings Affect Financial Markets

- Long-Term Effects of FOMC Decisions

- FOMC Meeting Schedule

- Data and Statistics Related to FOMC Meetings

- Historical Perspective on FOMC Meetings

- Conclusion

What is FOMC?

The Federal Open Market Committee (FOMC) is a key component of the Federal Reserve System, the central banking system of the United States. Established in 1913, the Federal Reserve plays a vital role in maintaining economic stability and promoting maximum employment, stable prices, and moderate long-term interest rates. The FOMC is responsible for implementing monetary policy through open market operations, which involve buying and selling government securities to influence the money supply and interest rates.

Role of FOMC in Monetary Policy

The FOMC's primary responsibility is to conduct monetary policy in a manner that promotes economic growth and stability. This involves setting target levels for the federal funds rate, which is the interest rate at which banks lend to each other overnight. By adjusting this rate, the FOMC can influence borrowing costs for consumers and businesses, thereby affecting economic activity.

- Monetary policy tools include open market operations, reserve requirements, and discount rates.

- The FOMC aims to achieve its dual mandate of price stability and maximum employment.

- Decisions made during FOMC meetings are based on comprehensive economic data and analysis.

FOMC Meeting Overview

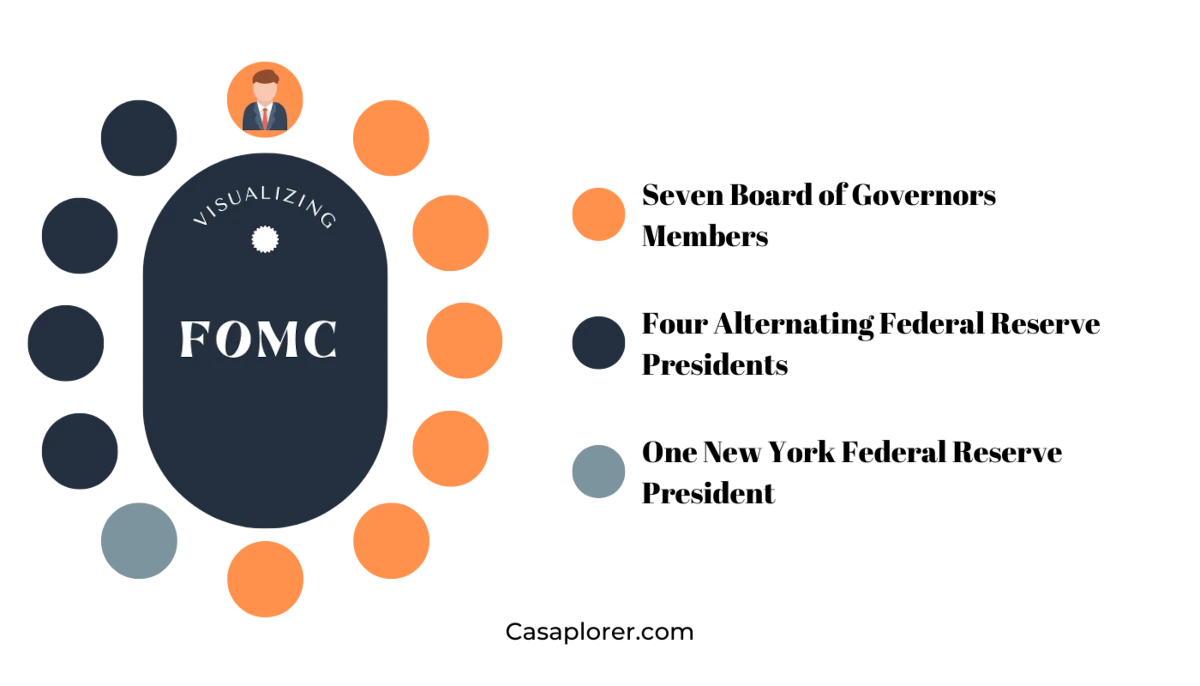

FOMC meetings are held eight times a year, typically every six weeks. During these sessions, committee members review economic and financial conditions, assess risks to the economic outlook, and determine the appropriate stance of monetary policy. The meetings are attended by the seven members of the Board of Governors and five Reserve Bank presidents, who rotate voting responsibilities.

Structure of FOMC Meetings

The FOMC meeting agenda includes presentations on current economic conditions, discussions on monetary policy options, and a vote on policy decisions. The meeting concludes with the release of a statement summarizing the committee's actions and rationale. Additionally, quarterly meetings include updated economic projections and a press conference by the Federal Reserve Chair.

- Meetings last for two days, with the first day focusing on economic analysis and the second day on policy deliberations.

- Voting members consist of the Board of Governors and Reserve Bank presidents.

- The meeting minutes are released three weeks after the conclusion of each session.

Key Decisions Made During FOMC Meetings

The primary focus of FOMC meetings is to decide on the appropriate level of the federal funds rate. This decision is based on a thorough analysis of economic indicators such as inflation, unemployment, and GDP growth. The committee also evaluates the risks to the economic outlook and considers international economic developments.

Read also:Mastering Basketball A Comprehensive Guide To Skills History And Expertise

Factors Influencing FOMC Decisions

Several factors influence the FOMC's decisions, including:

- Inflation trends and expectations

- Employment and labor market conditions

- Gross Domestic Product (GDP) growth

- Global economic developments

- Financial market stability

Economic Impact of FOMC Meetings

The decisions made during FOMC meetings have a profound impact on the U.S. economy. By adjusting interest rates, the FOMC can influence consumer spending, business investment, and overall economic activity. Lower interest rates encourage borrowing and spending, while higher rates curb inflation by reducing demand.

Effects on the Economy

The economic impact of FOMC meetings can be seen in various sectors:

- Lower interest rates stimulate housing and automobile sales.

- Higher interest rates reduce inflationary pressures but may slow economic growth.

- Monetary policy decisions affect government borrowing costs and budgetary decisions.

How FOMC Meetings Affect Financial Markets

FOMC meetings are closely watched by financial markets, as they provide insight into future monetary policy actions. Changes in interest rates can have significant effects on stock prices, bond yields, and currency values. Market participants analyze the FOMC statement and press conference for clues about the committee's future policy intentions.

Market Reactions to FOMC Decisions

Financial markets often react swiftly to FOMC announcements:

- Stock markets may rise or fall based on the perceived impact of monetary policy on corporate profits.

- Bond yields adjust in response to changes in interest rate expectations.

- Currency values fluctuate due to the influence of interest rates on capital flows.

Long-Term Effects of FOMC Decisions

The long-term effects of FOMC decisions can shape the trajectory of the U.S. economy. Consistent monetary policy can foster economic stability and growth, while erratic policy changes can lead to uncertainty and volatility. The FOMC's ability to manage inflation and employment is critical for maintaining public confidence in the financial system.

Significance of Long-Term Policy

Long-term policy decisions by the FOMC include:

- Setting inflation targets to anchor expectations.

- Implementing forward guidance to influence market expectations.

- Conducting quantitative easing or tightening to address economic cycles.

FOMC Meeting Schedule

The FOMC meeting schedule is predetermined and announced at the beginning of each year. The meetings are spaced approximately six weeks apart, allowing committee members to assess economic developments and gather data between sessions. Quarterly meetings include updated economic projections and a press conference.

2023 FOMC Meeting Dates

The 2023 FOMC meeting schedule includes the following dates:

- January 31 - February 1

- March 21 - March 22

- May 2 - May 3

- June 13 - June 14

- July 25 - July 26

- September 19 - September 20

- October 31 - November 1

- December 12 - December 13

Data and Statistics Related to FOMC Meetings

Data and statistics play a crucial role in FOMC decision-making. Committee members rely on a wide range of economic indicators to assess the state of the economy and determine the appropriate policy stance. Key data sources include:

- Consumer Price Index (CPI)

- Unemployment Rate

- Gross Domestic Product (GDP)

- Retail Sales

- Industrial Production

According to the Federal Reserve Economic Data (FRED), the U.S. economy has experienced varying levels of growth and inflation over recent years. These data points inform FOMC decisions and help guide monetary policy.

Historical Perspective on FOMC Meetings

The history of FOMC meetings provides valuable insights into the evolution of monetary policy. Over the decades, the committee has faced numerous challenges, including recessions, financial crises, and global economic disruptions. The FOMC's responses to these challenges have shaped the U.S. economy and influenced global financial markets.

Key Historical Events

Some notable historical events in FOMC history include:

- The Great Recession and subsequent quantitative easing programs.

- Interest rate normalization following the financial crisis.

- Response to the COVID-19 pandemic and economic recovery efforts.

Conclusion

The FOMC meeting is a critical component of the U.S. monetary policy framework, influencing economic conditions and financial markets both domestically and internationally. By understanding the mechanics and significance of these meetings, stakeholders can better anticipate economic trends and make informed decisions. The FOMC's commitment to price stability and maximum employment remains a cornerstone of its policy objectives.

We encourage readers to explore further resources and stay updated on FOMC developments. Your feedback and engagement are valuable, so please feel free to leave comments or share this article with others who may find it informative. For more insights into economic and financial topics, explore our other articles on related subjects.

Data Source: Federal Reserve