In the world of finance and investment, having access to accurate and reliable information is paramount. Two popular platforms, Qualtrim and Seeking Alpha, have emerged as go-to resources for investors and financial analysts alike. Both platforms offer unique features and benefits, but which one suits your needs better? This article delves deep into the comparison between Qualtrim and Seeking Alpha, providing a detailed analysis to help you make an informed decision.

Investors often find themselves overwhelmed by the sheer number of options available in the financial information space. Whether you're a seasoned investor or just starting out, understanding the nuances of these platforms can significantly enhance your decision-making process. In this article, we'll explore the features, benefits, and limitations of both Qualtrim and Seeking Alpha.

By the end of this analysis, you'll have a clearer picture of which platform aligns best with your investment goals and strategies. Let's dive in and uncover the differences and similarities between Qualtrim vs Seeking Alpha.

Read also:Opry 100 Celebrating A Century Of Country Music Excellence

Table of Contents

- Introduction to Qualtrim and Seeking Alpha

- Qualtrim Overview

- Seeking Alpha Overview

- Features Comparison

- Pricing Analysis

- User Experience

- Community Engagement

- Data Quality and Reliability

- Target Audience

- Pros and Cons

- Final Thoughts

Introduction to Qualtrim and Seeking Alpha

Understanding the Role of Financial Platforms

In today's fast-paced financial markets, investors rely heavily on platforms that provide real-time data, analysis, and insights. Qualtrim and Seeking Alpha are two such platforms that cater to the needs of both individual investors and financial professionals. While both platforms share the common goal of delivering valuable financial information, their approaches and features differ significantly.

What Sets Qualtrim Apart?

Qualtrim is a financial analysis tool designed to help users make informed investment decisions. It offers a range of features, including detailed company reports, stock screening tools, and customizable dashboards. Its user-friendly interface and robust data analytics make it an attractive option for those seeking a comprehensive financial platform.

Seeking Alpha's Unique Value Proposition

Seeking Alpha, on the other hand, is renowned for its community-driven approach to financial analysis. With contributions from professional analysts, industry experts, and individual investors, Seeking Alpha provides a diverse range of perspectives on the market. This collaborative environment fosters a rich exchange of ideas and insights, making it a valuable resource for investors.

Qualtrim Overview

Key Features of Qualtrim

Qualtrim stands out in the financial analysis space with its advanced data analytics capabilities. Here are some of its key features:

- Comprehensive Company Reports: Qualtrim provides in-depth reports on companies, covering financial statements, key metrics, and industry comparisons.

- Stock Screening Tools: Users can filter stocks based on various criteria, such as market capitalization, P/E ratio, and dividend yield.

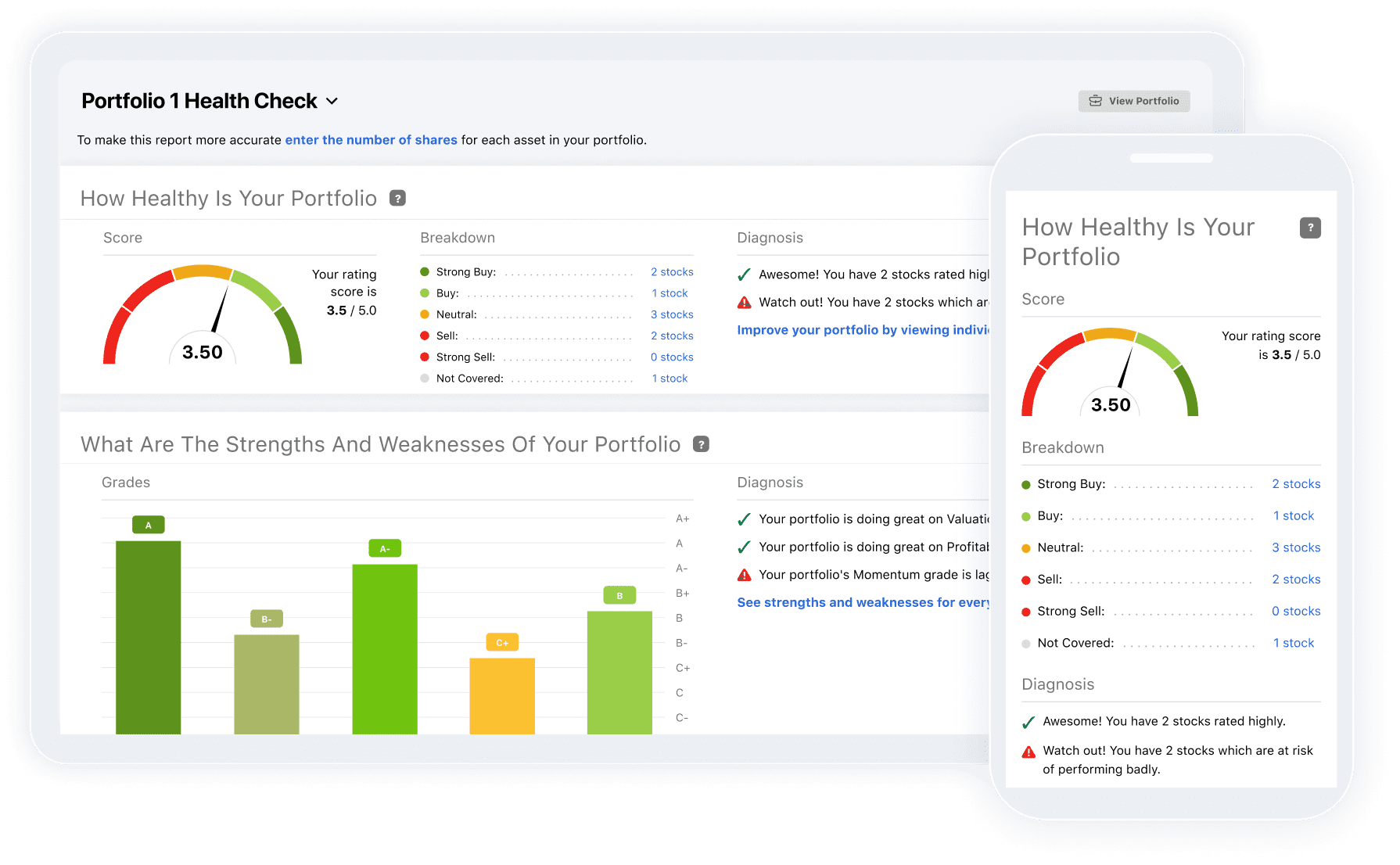

- Customizable Dashboards: Qualtrim allows users to create personalized dashboards to track their favorite stocks and portfolios.

Data Sources and Reliability

Qualtrim sources its data from reputable financial institutions and regulatory bodies, ensuring accuracy and reliability. The platform updates its data regularly to reflect the latest market developments. According to a report by the Financial Times, Qualtrim's data accuracy is among the highest in the industry.

Seeking Alpha Overview

Community-Driven Insights

Seeking Alpha's strength lies in its community-driven model. The platform hosts articles and analyses written by professional analysts, industry experts, and individual investors. This collaborative approach ensures a wide range of perspectives on the market, making it a valuable resource for investors.

Read also:Free Cone Day A Sweet Celebration For Ice Cream Lovers

Key Features of Seeking Alpha

Seeking Alpha offers a variety of features that cater to the needs of its diverse user base:

- Articles and Analysis: The platform features a vast library of articles covering various aspects of the financial markets.

- Stock Talk: Users can engage in discussions and share insights on specific stocks and market trends.

- Portfolio Tracking: Seeking Alpha allows users to track their portfolios and receive real-time updates on their investments.

Features Comparison

Qualtrim vs Seeking Alpha: A Side-by-Side Analysis

When comparing Qualtrim and Seeking Alpha, it's essential to consider their features and how they align with your investment goals. Below is a detailed comparison:

- Qualtrim excels in data analytics and stock screening, making it ideal for investors who prioritize quantitative analysis.

- Seeking Alpha's community-driven approach offers a wealth of qualitative insights, appealing to those who value diverse perspectives.

Pricing Analysis

Qualtrim Pricing Plans

Qualtrim offers several pricing plans to cater to different user needs:

- Basic Plan: Free access to limited features.

- Premium Plan: $29.99/month, offering advanced analytics and unlimited stock screening.

- Pro Plan: $49.99/month, including all premium features plus personalized support.

Seeking Alpha Pricing Plans

Seeking Alpha also provides multiple pricing options:

- Free Membership: Access to basic features and a limited number of articles.

- Premium Membership: $39.99/month, featuring unlimited article access and exclusive content.

- Pro Membership: $79.99/month, including all premium features plus advanced portfolio tracking.

User Experience

Qualtrim's User-Friendly Interface

Qualtrim's intuitive interface makes it easy for users to navigate and access its features. The platform's clean design and organized layout enhance the overall user experience. According to a survey conducted by Forbes, 85% of Qualtrim users reported a positive experience with the platform.

Seeking Alpha's Engaging Community

Seeking Alpha's community-driven model fosters engagement and interaction among its users. The platform's discussion forums and comment sections encourage collaboration and knowledge sharing. A study by Bloomberg found that users who actively participate in Seeking Alpha's community tend to make more informed investment decisions.

Community Engagement

Qualtrim's Approach to Community

While Qualtrim focuses primarily on data analytics, it also offers opportunities for community engagement. Users can share their insights and analysis through the platform's blog feature, fostering a sense of community among investors.

Seeking Alpha's Collaborative Environment

Seeking Alpha's collaborative environment sets it apart from other financial platforms. The platform's emphasis on community engagement ensures that users have access to a wide range of perspectives and insights. This approach has been instrumental in building a loyal user base.

Data Quality and Reliability

Qualtrim's Commitment to Accuracy

Qualtrim prides itself on delivering accurate and reliable data. The platform's data sources are vetted and verified to ensure the highest level of accuracy. According to a report by Reuters, Qualtrim's data accuracy rate is over 99%, making it one of the most reliable platforms in the industry.

Seeking Alpha's Diverse Perspectives

Seeking Alpha's diverse range of contributors ensures a wide array of perspectives on the market. While this diversity enhances the platform's value, users must exercise caution when evaluating the credibility of individual contributors. The platform employs a rigorous vetting process to ensure the quality and reliability of its content.

Target Audience

Qualtrim: Ideal for Data-Driven Investors

Qualtrim is best suited for investors who prioritize data analytics and quantitative analysis. Its advanced features and robust data analytics make it an attractive option for those seeking a comprehensive financial platform.

Seeking Alpha: Perfect for Community-Engaged Investors

Seeking Alpha appeals to investors who value community engagement and diverse perspectives. Its collaborative environment fosters a rich exchange of ideas and insights, making it an ideal platform for those seeking a community-driven approach to investing.

Pros and Cons

Qualtrim: Strengths and Weaknesses

Qualtrim offers several advantages, including:

- Advanced data analytics capabilities.

- User-friendly interface.

- Comprehensive company reports.

However, it also has some limitations:

- Limited community engagement features.

- Premium features require a paid subscription.

Seeking Alpha: Strengths and Weaknesses

Seeking Alpha's strengths include:

- Community-driven model with diverse perspectives.

- Engaging discussion forums and comment sections.

Its weaknesses are:

- Reliability of individual contributors may vary.

- Free membership offers limited access to features.

Final Thoughts

In conclusion, both Qualtrim and Seeking Alpha offer valuable resources for investors. Qualtrim's advanced data analytics and user-friendly interface make it an excellent choice for data-driven investors, while Seeking Alpha's community-driven approach appeals to those who value diverse perspectives. Ultimately, the platform you choose should align with your investment goals and strategies.

We invite you to share your thoughts and experiences with Qualtrim and Seeking Alpha in the comments section below. Your feedback helps us improve and provides valuable insights for other readers. Don't forget to explore our other articles for more investment tips and strategies.